Products

Cooper Investors Global Equities Fund (Hedged)

Fund Objective

The objective of the fund is to outperform the benchmark over the long term.

The Fund will be constructed with limited reference to the benchmark, and therefore the fund’s returns may vary significantly from the Benchmark’s return.

Investment Strategy

The Investment Manager aims to invest in the most attractive investment opportunities identified by CI’s VoF research philosophy, through the lens of a long term investment horizon.

The Investment Manager will apply the CI Way which includes applying the VoF methodology applied to a focused Watchlist of companies, a combination of quantitative and qualitative research and an extensive company visitation programme.

Diversification of portfolio risks will be achieved through owning stocks across different countries, currencies, industries and market capitalisations.

Portfolio construction is implemented with limited reference to the Benchmark. Specific stock, country and industry weightings are entirely at the discretion of the Manager and will be selected based on the risk and return profiles of the industries and stocks in question.

The Fund is a long only portfolio of 30-50 global stocks. The manager will use forward exchange contracts or options to hedge out most currency risk on the foreign assets.

Fund Facts

Portfolio Managers: Chris Dixon, Allan Goldstein

Inception Date: 1st December 2004*

Benchmark: MSCI AC World Net of Dividends in local currency.

Fees: 1.20%

Performance Fee: 10% of the Fund’s out performance of the Benchmark. A high water mark applies.

Distributions: Half yearly 31 December, 30 June

*Initially the Fund invested predominately in Australian equities. However, since May 2006 the Fund has been invested in a broad range of global equities.

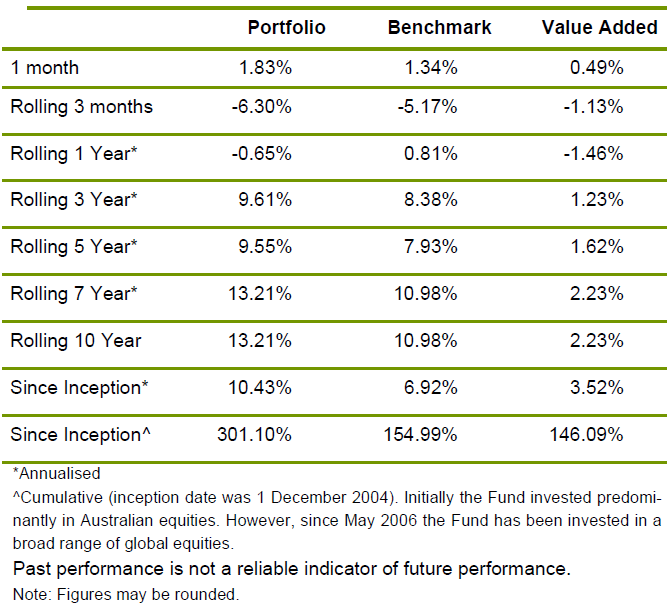

Performance - Net Returns as at 30 November 2018

Monthly Fact Sheet: click here

Quarterly Commentary: click here

How to Invest

1. Download and read PDS

2. Complete Application Form

3. Send Application to NAB